Saturday, December 31, 2011

Some words for 2012...

It doesn't interest me

what you do for a living.

I want to know

what you ache for

and if you dare to dream

of meeting your hearts longing.

It doesn't interest me

how old you are.

I want to know

if you will risk

looking like a fool

for love

for your dream

for the adventure of being alive.

It doesn't interest me

what planets are

squaring your moon...

I want to know

if you have touched

the centre of your own sorrow

if you have been opened

by life's betrayals

or have become shrivelled and closed

from fear of further pain.

I want to know

if you can sit with pain

mine or your own

without moving to hide it

or fade it

or fix it.

I want to know

if you can be with joy

mine or your own

if you can dance with wildness

and let the ecstasy fill you

to the tips of your fingers and toes

without cautioning us

to be careful

to be realistic

to remember the limitations

of being human.

It doesn't interest me

if the story you are telling me

is true.

I want to know if you can

disappoint another

to be true to yourself.

If you can bear

the accusation of betrayal

and not betray your own soul.

If you can be faithless

and therefore trustworthy.

I want to know if you can see Beauty

even when it is not pretty

every day.

And if you can source your own life

from its presence.

I want to know

if you can live with failure

yours and mine

and still stand at the edge of the lake

and shout to the silver of the full moon,

Yes.

It doesn't interest me

to know where you live

or how much money you have.

I want to know if you can get up

after the night of grief and despair

weary and bruised to the bone

and do what needs to be done

to feed the children.

It doesn't interest me

who you know

or how you came to be here.

I want to know if you will stand

in the centre of the fire

with me

and not shrink back.

It doesn't interest me

where or what or with whom

you have studied.

I want to know

what sustains you

from the inside

when all else falls away.

I want to know

if you can be alone

with yourself

and if you truly like

the company you keep

in the empty moments.

- "The Invitation"- by Oriah Mountain Dreamer

If ever there were words that we need to remember, thoughts we need to think, feelings we need to feel for our voyage into this new annum…the above poem says it beautifully. As for us market particiapants these words take on even more meaning and value - remember them…and live them.

Here’s to a healthy and happy new year.

Friday, December 30, 2011

Happy New Year to everyone - but to Trichet, Mario, BURNanke, Timmy, Merkel, Sarkozy and the FED, may you have the 2012 that you all deserve and earned

Well here we are, another year bites the dust and we are not better for it. To everyone who have had to put up with the clowns in charge and who have had to suffer the consequences for their choices - I wish you a very successful, healthy and happy new year. However, to the clowns and manipulators who have mortgaged all our futures, have privatized profits and socialized gargantuan amounts of losses and wreaked havoc on our markets and the essence of capitalism and entrepreneurship…I wish you the exact thing that you deserve - Next Year…

I am far from a bitter person, I have had an extremely successful year this year and can only hope that next year is as bountiful and amazing as this one was. But all the good things that I have been fortunate to experience this year DO NOT detract from my downright DISGUST and ANGER at what BURNanke, G-Heist-ner, Obama, Merkel, Trichet, Draghi, Sarkozy and people of their ilk and echelon have done to our society and world. For that, YES, I am bitter.

I am far from a bitter person, I have had an extremely successful year this year and can only hope that next year is as bountiful and amazing as this one was. But all the good things that I have been fortunate to experience this year DO NOT detract from my downright DISGUST and ANGER at what BURNanke, G-Heist-ner, Obama, Merkel, Trichet, Draghi, Sarkozy and people of their ilk and echelon have done to our society and world. For that, YES, I am bitter.

Thursday, December 29, 2011

And the tension increases...

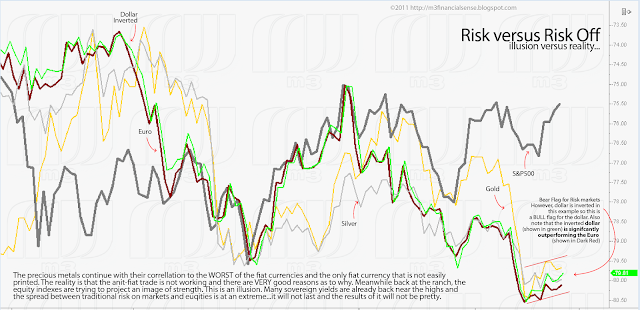

While we were, as of the close yesterday, in need of some sort of bounce to retrace the selling from yesterday…that will likely only be short and brief. The reality is that given yesterday’s activity, the internal dissension in the markets increased rather than decreased. So, yesterday ratcheted up the tension rather than eased it. Today’s rally is further dislocating risk assets prices versus the dollar and will likely end up exacerbating any further market action…in addition, note that Silver and Gold are leading the EURO lower…

Wednesday, December 28, 2011

Housing Prices - the real story...

Housing prices are just like any other market - highly symmetrical. In comparison to the flawed presentations of the prices in the graph at the bottom of this post…I propose a clearer view of what is plausible…if not likely - as I see the Ritholtz scenario as relatively unlikely and rather optimistic. Instead it seems to me that the unwind of commodities and hard assets like Silver, Palladium, Land and Real Estate will have MUCH further to fall and the rise in value of CASH will have much higher to rise than people seem to understand or able to imagine. I find the projection in the ritholz example to be highly unimaginative given the behaviour of prices on a percentage basis in the past. The key to understanding this is that most markets seek symmetry and in this case both the dollar and housing prices are in fact doing exactly that.

Below is the chart presented on the ritholz.com site which I think is rather in effective in telling the real story.

Tuesday, December 27, 2011

The cup is empty and its poison has spilled...

I must say…this Christmas feels different. Parking lots at mall’s were nearly empty leading up to Christmas, Ron Paul is fighting off the scammer establishment who can only find a few newsletters to gripe about despite his voting track record indicating clearly that his actions and philosophy are pro human, pro liberty and pro-capitalist…no discrimination there. The markets of course have been so manipulated by the anti-capitalist central planners and government officials intent on throwing away our children's future and enslaving us in to permanent debt that they are not capitalist at all. Just take a look at what happened to the Spanish bonds last week. Apparently the ECB, as I indicated when it happened, pulled together all the muster that they could find and provided an offer for every single ask on newly issued Spanish bonds…bringing yields down to the low 2% area…this was roughly a 50% reduction in yield…not to be out done…the market has now answered and yields are right back where they were before the central planners decided that they are the market an know better than the market and they are the only true capitalists.

The problem is that Merkozy and Ben, Timmy and Mario are all taking way to many shortcuts. There is no short cut that can work when you give money to people who are only good at losing it. The debt orgy from the ECB last week only rewarded people who are already insolvent and who have already lost the money they borrowed…which is why they are not investing it in new bonds. The fact is, the ECB is willing to accept any kind of collateral, even collateral that has been pledged somewhere else. I guess they will just call that little issue a discrepancy or oversight or accounting error - rather than intentional accounting fraud.

The problem is that Merkozy and Ben, Timmy and Mario are all taking way to many shortcuts. There is no short cut that can work when you give money to people who are only good at losing it. The debt orgy from the ECB last week only rewarded people who are already insolvent and who have already lost the money they borrowed…which is why they are not investing it in new bonds. The fact is, the ECB is willing to accept any kind of collateral, even collateral that has been pledged somewhere else. I guess they will just call that little issue a discrepancy or oversight or accounting error - rather than intentional accounting fraud.

Monday, December 26, 2011

Overshoots, breakouts and failures…welcome to the market

Here we are again with everyone trying to call and trade breakouts. Well I have news for you, breakout trading has been a relative disaster this year…most every breakout triggers just far enough to get everyone on board and then immediately aims for their stops…usually on the opposite side of the breakout where they stop & reverse to go the opposite direction to play the whole thing all over again. In fact, as a general rule, MOST breakouts become failures no matter what the market.

The strange thing is that though this is the case for most breakouts and though trendlines must be continuously redrawn people continue to try to trade them. Breakout targets if trendlines are not redrawn are at 1.128 or 1.272 extensions before a reversal. This is likely again the trap that is setting up for many of the indices right now. And again, it reflects a real effect…the majority of losses do not come from people being wrong on trades but reversing and reversing and finally reversing again.

I will point you to my chart of the Utilities once again for a live example of one of these events in progress…you will hear CNBC and all the people who can promote it sharing the breakout status on a few indexes…the key is not to get trapped in the reversal of the breakout when it turns into a failure…the Utilties have overshot though ideally could move just a little bit higher (though this is not necessary) before it entangles its victims.

The strange thing is that though this is the case for most breakouts and though trendlines must be continuously redrawn people continue to try to trade them. Breakout targets if trendlines are not redrawn are at 1.128 or 1.272 extensions before a reversal. This is likely again the trap that is setting up for many of the indices right now. And again, it reflects a real effect…the majority of losses do not come from people being wrong on trades but reversing and reversing and finally reversing again.

I will point you to my chart of the Utilities once again for a live example of one of these events in progress…you will hear CNBC and all the people who can promote it sharing the breakout status on a few indexes…the key is not to get trapped in the reversal of the breakout when it turns into a failure…the Utilties have overshot though ideally could move just a little bit higher (though this is not necessary) before it entangles its victims.

Ron Paul…coming to an electoral theatre near you

As momentum builds in america against the central planning autocracy and it political elites…so too will support for Ron Paul…

Sunday, December 25, 2011

Saturday, December 24, 2011

When 16 out of 16 analysts are looking for the least controversial means to further their firms agendas and charge their 2% management fees for providing terrible and useless advice, you know something is not what it seems. These guys have to be living in a different world and clearly can not understand basic economics. If ever there were a great indicator as to doubt, its the Barron’s round table and the asundry year end analysis from average to below average analysts with litte conviction.

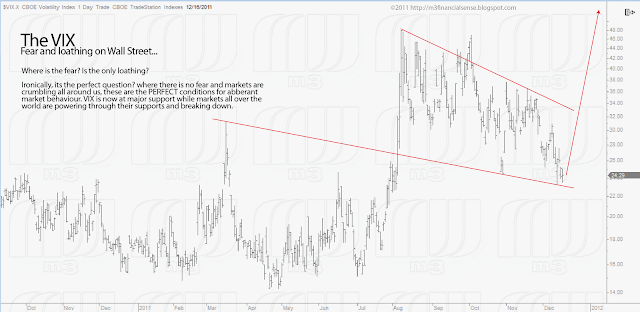

In any case, here we are, and the central planners have succeeded in ramping the market while no one has been around and while people are attempting to be in holiday cheer. This ramp changes nothing and it gives no confirmation to any of the harebrained analysis from the dufus analysts in the pictured article. Below are some interesting charts to think about before all the year end pumpers come back to work next week.

Friday, December 23, 2011

Treasuries - interesting action today...

If these setups are as they appear…top tick in this bounce either occured on Friday or will do so early next week. Since futures will trade on Monday (Forex trades Sunday), it woud be very common for them to open flat, an unlikely but possible push to one more high in the futures markets and sell off hard - all before the equity markets had a chance to print any quotes. This scenario could have us opening gap down in the Equities markets on Tuesday if it were to playout as seems to be suggested by the Treasury charts below.

Risked up to their eyeballs…some charts for christmas

Much to my surprise the brilliance of Mr. Market needed to push an already VERY extreme dislocation in prices even further…so the markets rallied and rallied in the face of ever increasing internal stresses. I will be posting quite a few charts…nothing has changed from last weekend in any significant way except for the fact that the markets are more stretched and dislocated than before. How the risk markets can rally in the face of the fact that many European sovereign bonds are back into stratosphere yields, is something I can not answer - though I think the centrally planned market dynamic probably has something to do with it in addition to many people being over leveraged on the short side.

And NO the TBill yield persistently effectively at negative yield is NOT bullish…all in all, this Christmas especially, the Masquerade is back in full regalia.

Merry Christmas.

And NO the TBill yield persistently effectively at negative yield is NOT bullish…all in all, this Christmas especially, the Masquerade is back in full regalia.

Merry Christmas.

Wednesday, December 21, 2011

Ron Paul…his message is "restore america"

Somehow I find that significantly more believable than some amorphous ambivolent “Change you can believe in” rhetoric.

This is good news?…not it you judge a book by its cover...

This cover says exactly what I posted yesterday, financial engineering at its level best of its worst. These guys fabricated lower yields, fabricated data and fabricated the leverage with which to create the illusion. They made this whole thing up. Ususally exceeding expectation is a good thing - NOT IN THIS CASE.

The banks that borrowed, borrowed from an already insolvent ECB and with their appetite, confirmed just how desperate everyone involved really is. What’s more, is that this loan facility just makes everything worse, with the exception of the ONE DAY bounce we got…and that, as you can see, will not be a lasting legacy.

The dollar responded by testing the support level in the neckline of the Cup and Handle pattern and came down to the lower trend line as marked. Now the ridiculous policy of lending bankrupt institutions money that they can not and will not be able to repay will be justly rewarded.

Risk assets are now likely toast and the weekend charts that I posted are still 100% on track though they may have to wait for this holdiay week to pass. Of course, the equity volatility was higher than I would have liked but, all in all, NOTHING has changed and NOTHING has been FIXED.

The banks that borrowed, borrowed from an already insolvent ECB and with their appetite, confirmed just how desperate everyone involved really is. What’s more, is that this loan facility just makes everything worse, with the exception of the ONE DAY bounce we got…and that, as you can see, will not be a lasting legacy.

The dollar responded by testing the support level in the neckline of the Cup and Handle pattern and came down to the lower trend line as marked. Now the ridiculous policy of lending bankrupt institutions money that they can not and will not be able to repay will be justly rewarded.

Risk assets are now likely toast and the weekend charts that I posted are still 100% on track though they may have to wait for this holdiay week to pass. Of course, the equity volatility was higher than I would have liked but, all in all, NOTHING has changed and NOTHING has been FIXED.

Tuesday, December 20, 2011

Hopium is all this market has left

Below is an example of more freshly smoked hopium…Tyler just does not give up...

The pullback in the dollar offered wonderful opportunities for attractive prices which apparently insolvent European banks are not letting pass without being noticed…I also, did not let the dollar prices go unnoticed.

The spread between the Dollar and inverted S&P500 has not come in and will likely lead to a brutal resumption of the previously scheduled programming in the not too distant future.

The Dollar and the EURO

Lets see if a directly engineered yield in a single new spanish bond issuance and games with German confidence numbers really means anything…likely it will not.

Sunday, December 18, 2011

Subscribe to:

Posts (Atom)