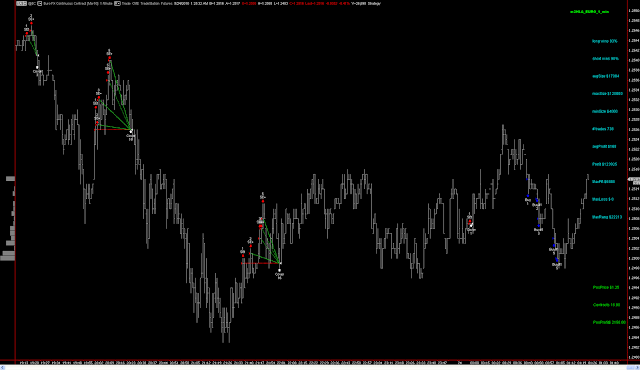

Despite the exits from the longs yesterday...

many of the long-term models are not yet short...however, they are setting up for that likelyhood and this presents a likely huge opportunity. I would like to state for the record that IF these systems trigger short...its most likely the end of this grand-puff-job perpetrated by the fed and their cronies. In case you need a little sunlight on that read below:

The U.S. Federal Reserve is also active in currency markets, German Economics Minister Rainer Bruederle said Friday.

His comments come on the heels of remarks made by his Swiss counterpart who said that the Swiss National Bank purchased euros to buttress the single currency.

"It is a regular procedure of central banks," to intervene in currency markets, Bruederle said. "It is not a secret," that central banks have a foreign exchange rate target, he added.

Bruederle said "eruptive" movements have to be avoided. He previously said that China holds 25 percent of its foreign exchange reserves in euros.

If the fed feels that they need to participate in the currency markets...treasury markets, bond markets, derivative markets - why not stock markets - stock market futures no less? Where will they stop? In any case, the one thing that is clear is that the Fed will lose...the main question is when? Everything in my system work is saying its pretty soon - if not now. A rally is possible, not necessary.

While it is unlikely for these systems to miss a big short...the fact that the market fundementals are so poor and the units that are used to price these markets (ie currencies) so flawed...we can not under-estimate the risks of there being relatively little follow through to the upside. Which ever way the winds decide to blow, I will try to keep some general market triggers available through my blog. It is just too much work for me to publish every signal, but it is important for me that there is some reasonable information available regarding this potentailly dangerous setup in the markets.

Currently, the only systems still with a view that this may be a dip are the Small Cap systems. That could change in a jiffy however and

I take the recent exits from long positions VERY seriously.