Over the last week, we have heard many politicians in France swear that there was NO WAY France would lose its pristine debt rating. We will assuredly hear the same from German politicians too. Well, some of those politicians got them anyway regardless of their protests and attempts to project them out of their future. However, the issue at hand has nothing to do with slow moving credit analysts assessments. These agencies are always late to the party or the best case is that they are trying to save face in front of a major calamity. These same agencies missed making a single warning regarding CDO’s and MBS in 2007 and most likely want to look at least a little more credible now. However, the implosion can be seen in what people are not saying…because what they are saying is a complete distraction. The reality of the matter is that the biggest commercial banks in Europe are insolvent and will transfer their losses to their public sectors in the imminent future. Both Germany and France have sold more than their entire economic future trying to prevent the collapse of their largest and highest levered institutions. The entire reason for all these gymnastics is that the worst banking implosions lie in France and Germany for Europe right now. Germany in particular wants to cover up its highly risky and highly leveraged betting parlors affectionately called banks.

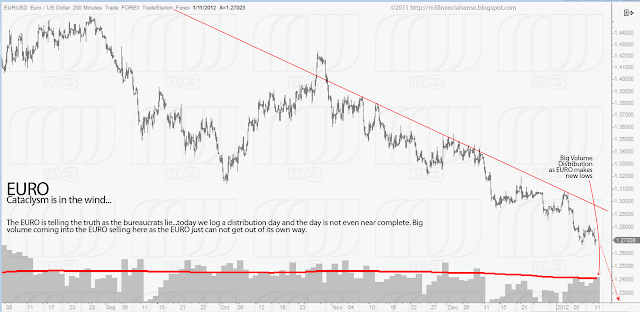

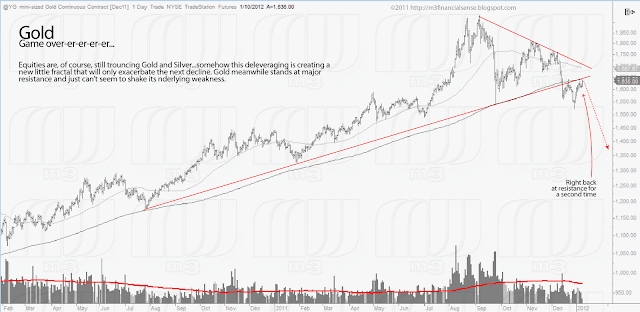

One can see the desperation in the markets. The constant bid under US equities. The persistent sale of assets that we previously viewed as safe havens - such as Gold and Silver…there is quite a lot of selling other very large markets aswell…however, those are holding up. What we are witnessing is most likely the largest collapse of credit in history. So, despite JP Morgan’s prognostications about its increased lending to business - small and large alike. The question has to be asked, if people are successfully able to borrow money, what are people doing with the it? In the case of large public companies - they are going into a lot of debt in order to finance purchases of stock so that they can shrink their float and keep demand and supply sustaining high prices for their securities. When you really look at their actions though, their balance sheet may show an apparent high level of cash…in reality they have a very high level of debt collateralized by their stock. IF stock prices fall, these companies will not be able to repay these borrowings. It is the case, that our society has used leverage for exactly the wrong objectives…to manipulate prices rather than to capitalize on opportunity.

Jamie Dimon, suggests that, with the exception of one or two U.S. banks…american banks are in great shape. I beg to differ with his myopic and self-reinforcing point of view. Globally banks are VERY weak and have continued to increase the risk of their practices with more and more aggressive accounting and book marking activity. Sure, if you want to accept those marks and assumptions - things look a hell of a lot better than they are and possibly just hunky dory. But our next MF Global is waiting and it may well be Goldman Tax or JP MOREgan. Jamie Dimon also suggests that his bank could lose 5 billion to problems in Europe…how much would you like to bet that the number is many orders of magnitude bigger than that even using JPM’s persistent accounting manipulation techniques? The charade is on but at some point soon people will be unmasked.

One, Warren Buffett has been buying one crappy security after the next and continuing telling people not to own treasuries…somehow people accept his analysis without looking at the real results…and now he is recently presented as the “wise optimist peering into the future with control of everything over which he presides". Warren’s activities over the last 8 years have been far from insightful and I find his analysis has been deliberately obfuscatory as well as misguided. May I suggest that the derivatives exposure and other complex insurance machinations driving a large amount of Berkshire’s performance are not going to play out as desired.

I previously wrote a post, “Insurance, Scam of the Ages”. Again, we stand on the precipice where people’s balance sheets are propped up with derivatives that make them look solvent - but were it for counter-party risk and exogenous events such as the recent large blowups in Greek bonds not being counted as a default and rendering the CDS useless. How did the insurance work there? if you owned the bonds and insured them - assuredly you would be telling your investors not to worry. However, now you are sitting on bonds down 80% and CDS that is relatively useless all because some bureaucracy decided that the insurance was not going to be triggered. That sounds kinds of like a complete wipeout loss to me that was supposed to be completely manageable. I stand by my previous post, Insurance, and its very expensive costs and complacency enforcing qualities are EXACTLY the same things that caused many other blowups throughout history. The entire structured products game is one big betting parlor based on the rationalization that its really insurance. I find it hard to call these products insurance. What they really are is money amplification tools and THAT is exactly the cause of most our woes.

How I see it is that the debt downgrades in Europe will accelerate as the agencies try to keep up with the pledges that will be coming back to bite its members. They will accelerate as their highly leveraged banks implode under the weight of increasingly devaluing asset prices. The foundations for this are all layed and visible in the action of the markets. These institutions are unwinding their balance sheets and are in the process of trying to sell the assets that are of most value to raise cash…we are about to see the turn into a waterfall of indiscriminate selling and revaluation exacerbated by the huge shortage of non-debt based cash/fiat money.

MiB: Bill Gurley, Benchmark

-

In a special bonus episode, I speak with Bill Gurley of Benchmark about

his big bets investing early in now-common names like Uber, Zillow,

Grubhub, ...

12 hours ago