Last week, both Ben Bernanke and President Obama put on performances that are ultimate charades. Obama I guess thinks that he can now get people to believe his document is authentic if he makes light of the whole thing as many times as possible and pretends it not important that he presented an unsound, unstress tested, manipulated and produced document. His audacity is simply amazing. Anyone wishing to see his performance can do so by

clicking here. Apparently, the objective of this performance was to demonstrate his limited satirical capability and the idiocy of Donald Trump...what he accomplished instead, semes to me, to reveal just how much he was intimidated. What a ridiculous state of affairs.

Osama was killed by order of Obama...now what a poetic concept that sounds out to be...however, it sounds, I think the president did a nice job on this performance

(certainly much better than his press club performance) and hopefully he will use this to extract our soldiers and resources from Afghanistan...though I am not holding my breath. In any case, the results of killing Osama are not entirely clear. Will this provoke a more active Al Queda and make them more dangerous or quell them into submission and make the world safer? Clearly Osama got to die the martyr that he wanted to be...so, his legacy is now complete and replete in addition to marketable. Whatever the case, though its a more than 10 year production, its finally done and Obama handled it well - at least he can get one feathr in his cap before his policies and complict compatriots impart their force

(or farce whichever may be more appropriate) on the economy.

Ben BURNanke on the other hand, does not understand basic economics or mathematics unless they apply first to his friends and shareholder's bonuses...He answered essentially no questions of any value but he did procure quite an amazing cast of softball throwing economics reporters - none of which had the nerve to ask him any even superficially real or substantive questions. What a sad state of affairs...meanwhile as BURNanke sets the stage for the next American revolution

(most likely among a few others)...its back to the regularly scheduled programming...

However, as much as many, including zerohedge, would like to have you believe that the fed is actually creating a lot of new money...upon a objective analysis the amount of money created in the system as a whole by the fed has been a great big ZERO. Nothing, Nada, Nope, Nein...

All of their QE and asset purchasing and other printing mechanisms have not grown the objective money supply at all. That's because as much money as they create, there is more being destroyed elsewhere in the system. Additionally their new money is trapped in pockets that do not make it into the economy unless you happen to like commodity or stock inflation. My post

Swan Dive...the real picture...Bonds versus Equities...Debt versus Cash stands as the correct interpretation of what will happen after the capitulation exhausts and when the system accounts for the real state of the money supply.

Good luck with your next job Ben...

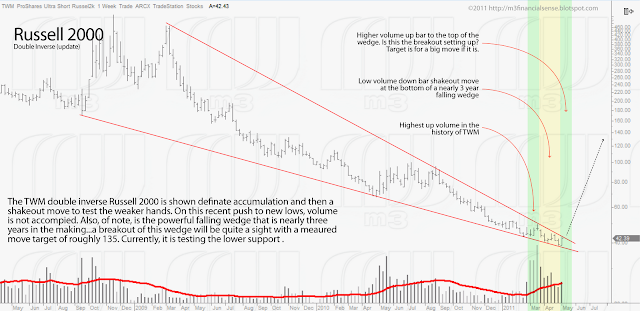

As I had indicated in this and previous posts, some markets are capitulating, Silver and the Dollar especially, while others are topping, as the Russell, SP500, Dow, Nasdaq etc. Commodities are inflationary assets

(as are stocks) primarily traded via leveraged instruments and we can see the results of that leveraged speculation in the silver markets tonight down 15% from the highs with much more to come. These commodity markets are topping in very long-term cycles that will usher in long-term bear markets for them. I actually heard one analyst suggest yesterday that if there was selling out of commodity markets it would likely drive equity markets higher. I have NEVER heard a more ridiculous assertion. Remember, equities are inflationary assets and subject to leveraged trading too...So, if one were to look at the silver market tonight...the margin calls there, especially for trade pyramiding momentum traders, will cause their carry trades and their other correlated trades to unwind all at once. Silver traders who are long the Russell will be forced to sell it...and as Silver has about 30 to 40 dollars left to fall...they will likely be selling for quite a long time once it really gets going. I am short silver from an average of about 47ish... I covered some on this drop though I expect much lower prices.

There is no foundation for valuations nor promotions that have been trumpeted to the masses by the press, officials and many analysts. Fukushima, Wikileaks, Foreclosuregate, the financial crisis, Iraq, Iran and even Lybia are barely in the news anymore...though they are all still threats in their respective ways for the US according to our officials...yet we are not humored with them anymore by the media for what ever reason. The bell will not ring and the press will not sing while the markets are heading for a liquidity crash that has the potential to make the flash crash look small in comparison. And soon...So, its time to be careful, as this last gap and go, is a trap of quite significant proportions and sets up the next Swan Dive in my opinion. My targets of the last drop were 1290 to 1300...I did expect a bounce but this was way out of the proportions that I was thinking...however I think the coming drop will take us to the lower targets in the 1150 to 1200 initially.

The funny thing is that the rally out of the debt downgrade happened right after the mission to kill or capture Osama was authorized by Obama...seems like buy the rumor and sell the news to me...and also a good explanation for the inexplicable behavior and highly abberant behavior of the markets over the last week or so. Many people will be able to thank BURNanke and his cohorts for the malinvestment and misallocation of capital that will exaccerbate the credit contraction and create such large losses in asset values.