When 16 out of 16 analysts are looking for the least controversial means to further their firms agendas and charge their 2% management fees for providing terrible and useless advice, you know something is not what it seems. These guys have to be living in a different world and clearly can not understand basic economics. If ever there were a great indicator as to doubt, its the Barron’s round table and the asundry year end analysis from average to below average analysts with litte conviction.

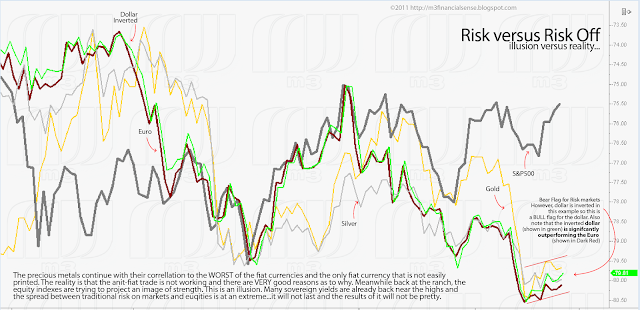

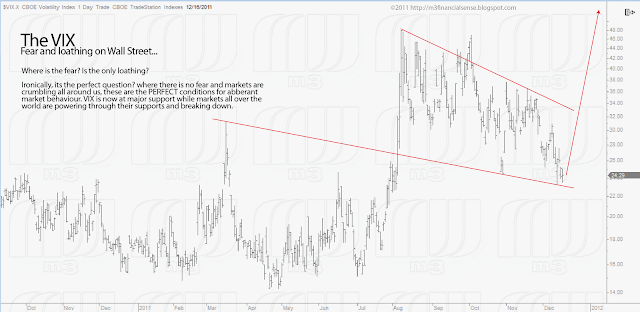

In any case, here we are, and the central planners have succeeded in ramping the market while no one has been around and while people are attempting to be in holiday cheer. This ramp changes nothing and it gives no confirmation to any of the harebrained analysis from the dufus analysts in the pictured article. Below are some interesting charts to think about before all the year end pumpers come back to work next week.