Is it any wonder that, the crash during Dubai week, was blamed on Dubai instead of all the PPT operators leaving early for thanksgiving...my view is that absence of PPT money in overnight futures let the market do exactly what it really wants to do...sell hard.

Submitted by TrimTabs' Charles Biderman

Are Federal Reserve and U.S. Government Rigging Stock Market? We Have No Evidence They Are, but They Could Be. We Do Not Know Source of Money That Pushed Market Cap Up $6+ Trillion since Mid-March.

The most positive economic development in 2009 was the stock market rally. Since the middle of March, the market cap of all U.S. stocks has soared more than $6 trillion. The “wealth effect” of rising stock prices has soothed the nerves and boosted the net worth of the half of Americans who own stock.

We cannot identify the source of the new money that pushed stock prices up so far so fast. For the most part, the money did not from the traditional players that provided money in the past:

- Companies. Corporate America has been a huge net seller. The float of shares has ballooned $133 billion since the start of April.

- Retail investor funds. Retail investors have hardly bought any U.S. equities. Bond funds, yes. U.S equity funds, no. U.S. equity funds and ETFs have received just $17 billion since the start of April. Over that same time frame bond mutual funds and ETFs received $351 billion.

- Retail investor direct. We doubt retail investors were big direct purchases of equities. Market volatility in this decade has been the highest since the 1930s, and we no evidence retail investors were piling into individual stocks. Also, retail investor sentiment has been mostly neutral since the rally began.

- Foreign investors. Foreign investors have provided some buying power, purchasing $109 billion in U.S. stocks from April through October. But we suspect foreign purchases slowed in November and December because the U.S. dollar was weakening.

- Hedge funds. We have no way to track in real time what hedge funds do, and they may well have shifted some assets into U.S. equities. But we doubt their buying power was enormous because they posted an outflow of $12 billion from April through November.

- Pension funds. All the anecdotal evidence we have indicates that pension funds have not been making a huge asset allocation shift and have not moved more than about $100 billion from bonds and cash into U.S. equities since the rally began.If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else.

We do not know where all the money has come from. What we do know is that the U.S. government has spent hundreds of billions of dollars to support the auto industry, the housing market, and the banks and brokers. Why not support the stock market as well?

As far as we know, it is not illegal for the Federal Reserve or the U.S. Treasury to buy S&P 500 futures. Moreover, several officials have suggested the government should support stock prices. For example, former Fed board member Robert Heller opined in the Wall Street Journal in 1989, “Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole.” In a Financial Times article in 2002, an unidentified Fed official was quoted as acknowledging that policymakers had considered buying U.S. equities directly, not just futures. The official mentioned that the Fed could “theoretically buy anything to pump money into the system.” In an article in the Daily Telegraph in 2006, former Clinton administration official George Stephanopoulos mentioned the existence of “an informal agreement among the major banks to come in and start to buy stock if there appears to be a problem.”

Think back to mid-March 2009. Nothing positive was happening, and investor sentiment was horrible. The Fed, the Treasury, and Wall Street were all trying to figure out how to prevent the financial system from collapsing. The Fed was willing to print whatever amount of money it took to bail out the system.

What if Ben Bernanke, Timothy Geithner, and the head of one or more Wall Street firms decided that creating a stock market rally was the only way to rescue the economy? After all, after-tax income was down more than 10% y-o-y during Q1 2009, and the trillions the government committed or spent to prop up all sorts of entities was not working.

One way to manipulate the stock market would be for the Fed or the Treasury to buy $20 billion, plus or minus, of S&P 500 stock futures each month for a year. Depending on margin levels, $20 billion per month would translate into at least $100 billion in notional buying power. Given the hugely oversold market early in March, not only would a new $100 billion per month of buying power have stopped stock prices from plunging, but it would have encouraged huge amounts of sideline cash to flow into equities to absorb the $300 billion in newly printed shares that have been sold since the start of April.

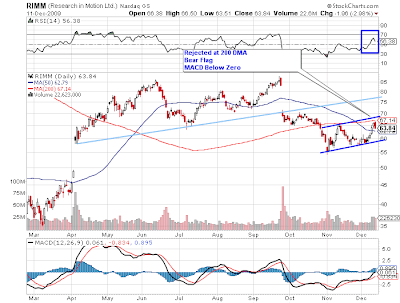

This type of intervention could explain some of the unusual market action in recent months, with stock prices grinding higher on low volume even as companies sold huge amounts of new shares and retail investors stayed on the sidelines. For example, Tyler Durden of ZeroHedge has pointed out that virtually all of the market’s upside since mid-September has come from after-hours S&P 500 futures activity.

If we were involved in a scheme to manipulate the stock market, we would want to keep it in place until after the “wealth effect” put a floor under the economy of, say, three quarters of positive GDP growth. Assuming the economy were performing better, then ending the support for stock prices would be justified because a stock market decline would not be so painful.

We want to emphasize that we have no evidence that the Fed or the Treasury are throwing money into the stock market, either directly or indirectly. But if they are not pumping up stock prices, then who else is?

Equity Mutual Fund Cash Equal to 3.8% of Assets in November, Just above Record Low of 3.5% in Mid-2007. U.S. Equity Funds Get Estimated $5.1 Billion in December, First Inflow in Five Months.

The Investment Company Institute reported Wednesday that equity mutual funds held just 3.8% of their assets in cash and equivalents in November. To put this percentage into perspective, the record low was 3.5% in June 2007 and July 2007. While the amount of cash increased $8.1 billion in November, assets shot up $229.1 billion, leaving the ratio of cash to assets unchanged.