The fact is that the Fed and their minions are at it again...desperately pushing their drugs on a string trying to facilitate their bankrupt cronies at the expense of the markets, the taxpayers and the financial system. It seems hard to imagine that an effort supposedly engineered to provide stability could be so stupidly engineered as accomplish exactly the opposite. Essentially today the Fed is doing EXACTLY what it did to accelerate the panic in the markets in 2008. They did not save the markets at all really because what they did do, however, was make the next problem...yes the one we are having now, 10X (10 times bigger) than the one they supposedly attempted to cure. So, if you were a normal human being and realized that your efforts resulted in a significantly greater problem than the one you would probably look at what you did that exacerbated it. Well, in the case of the Fed, what exacerbated the 2008 debacle was trying to cure credit problems with lots more credit. The fed is doing it again once again in replay mode, only this time in 3D. So, the result will be a total catastrophe. There is no other option.

Here is a press release:

Today, the Bank of Canada, the Bank of England, the European Central Bank

(ECB), the Federal Reserve, the Bank of Japan, and the Swiss National Bank

are announcing coordinated measures designed to address the continued

elevated pressures in U.S. dollar short-term funding markets. These

measures, together with other actions taken in the last few days by

individual central banks, are designed to improve the liquidity conditions

in global financial markets. The central banks continue to work together

closely and will take appropriate steps to address the ongoing pressures.

Federal Reserve Actions

The Federal Open Market Committee has authorized a $180 billion expansion

of its temporary reciprocal currency arrangements (swap lines). This

increased capacity will be available to provide dollar funding for both

term and overnight liquidity operations by the other central banks.

The FOMC has authorized increases in the existing swap lines with the ECB

and the Swiss National Bank. These larger facilities will now support the

provision of U.S. dollar liquidity in amounts of up to $110 billion by the

ECB, an increase of $55 billion, and up to $27 billion by the Swiss

National Bank, an increase of $15 billion.

In addition, new swap facilities have been authorized with the Bank of

Japan, the Bank of England, and the Bank of Canada. These facilities will

support the provision of U.S. dollar liquidity in amounts of up to $60

billion by the Bank of Japan, $40 billion by the Bank of England, and $10

billion by the Bank of Canada.

All of these reciprocal currency arrangements have been authorized through January 30.

Examining this press release, one can see that this essentially describes the liquidity action that the Fed took today. What's more the objectives are stated to provide short-term and overnight funding, what they omit is the "for our ponzi scheme" part. Moreover, the objective here really is to provide dollars to intermediates to make available for insolvent and dubious counterparties that would go broke with out them. What this means it that in order to allow operations say for Society Generale they required access to a certain amount of dollars, that they lacked the capability or credibility to purchase those dollars. As we know, everything is available for a price, however, when you are

not a particularly good risk and desperately need a particular security/asset to ensure you can meet basic obligations and need desperatey to remain credible...the price goes up. That also happens when the natural

result of too much credit defaulting creates an accute shortage in supply of NON IOU dollars.

What is happening here is that the entities whose way over leveraged balance sheets have grown even bigger and more obtuse over the last 2.5 years are now getting a handout from the central banks, who are all going to tell us that they are only taking pristine collateral for such access. Do you believe them? The Fed is buying third rate mortgages and has been buying bankrupt hotel debt...yeah right!

So, if we were to examine what occurred in the above press release, you would realize that the only thing missing is the dates. And they would be:

Release Date: September 18, 2008, For release at 3:00 a.m. EDT.

What happened next? Well clearly for these institutions to panic to this degree, their actions had the exact opposite effect than intended...Everyone was left asking

"just how much worse are the problems than we were being told?" Recognize the similarity? The market dropped 350 points on the S&P500 thereafter in less than a month.

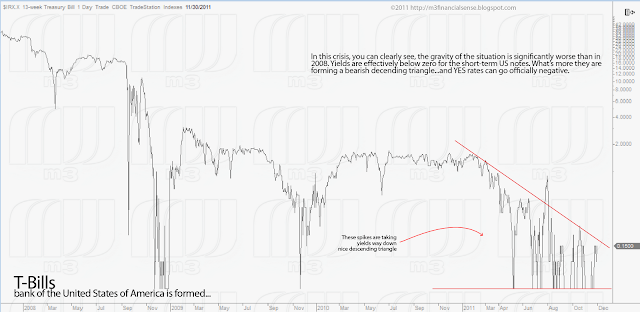

The Fed could not print or inject enough dollars in then, they most certainly will not be able to now. Will the same thing happen this time? My opinion is that probabilities favor the same type of result and will likely be part of an even bigger decline than 2008 because this time the Fed and its buddies are going in much bigger and they are seeking to give money to even more stretched and insolvent bankers and once again reward incompetence. They themselves are incompetent, so, I guess I can not blame them for not being able to recognize it in others...especially their cronies.

If the Fed was a poker player, they showed their hand...we now know they are scared...and now its the market's turn. I, somehow thing the market is a better poker player.