JP Morgan would like you to believe that their trading losses are 2 billion and could increase by another billion. I believe the losses will be 100% to 200% more than that by the time this is said and done. They would also like you to believe that releasing loan loss reserves via accounting maneuvers is equal to earnings. Not to mention that having the audacity to reduce loan loss reserves while credit quality is contracting and risk is increasing - its just simply ridiculous. The reality is that the quality of the whole financial sector’s earnings

(not to mention most S&P500 companies) has declined appreciably over the last 10 years and precipitously at the TBTF institutions.

On these pages you have heard many times before that JPM

(or any other large entity or market participant) can not manage or hedge its derivatives risk sustainably and effectively without mismarking and accounting shenanigans. Perfect hedges simply just don't exist and certainly if a perceived perfect hedge is found it s not without introducing other new and unforeseen risk and consequences. Hedges, however, are the excuse for increased leverage. To look at JPM’s Bruno Iksil CIO portfolio is particularly disturbing in that the capabilities and resources brought to bear there are representative of the capability of the entire bank's derivatives methodology. However, JPM and Jamie Dimon want us to believe that the decisions and risk management of positions were “

egregious" and that there were

“...many errors, sloppiness and bad judgment” involved. They really want the public to believe that somehow they have an isolated pocket of ineptitude and risk takers who are the only ones related to the issue. Jamie of course takes responsibility because they work for him…but he definitely does not want anyone to believe that JPM put their crack derivatives resources on this and still blew up. The only problem is that when you build a trillion dollar notional exposure there are no accidents. There is no isolation. There is no sloppiness and egregious counts towards the the chutzpah of the bank to try to make us believe their case. These types of positions require persistent and deliberate action usually over an extended period of time.

In the case of JPM, the reality is the JPM is a bucket shop that makes profits via accounting maneuvers, backroom deals and outright malfeasance and conflict of interest relating to client assets. Moreover, the institution is totally insolvent - as I have indicated many times before…the pursuit money amplification for profit generation and as the illusory element to shore up hopelessly unshored balance sheets has been chief on large banking cartel members like JPM and also the Fed’s agenda.

I used to work at JPM and I can tell you from my view their capability with regard to managing their nearly

80 trillion derivative book is no better run than this disaster. This is why it was and is of utmost importance that the Jamie and Ben show misdirect so that no one could confuse this isolated incident with a larger pattern of risk and flawed and hollow methodology employed in their whole derivatives book to further balance sheet fraud rampant in the whole financial system, executive compensation reward and ultimately to mask chronic insolvency.

If it were possible to move the marks to hide this particular blowup they would have done so. However, the outing of Bruno also made these trades and prices impossible to hide or cover up as they became the target of much smarter organizations than JPM. The really amazing thing is that this is just the tip of the iceberg with institutions levered 400 to 1 (Goldman Tax) and 80 trillion dollar derivatives books that are purported to be perfectly hedged

(an impossible and implausible reality) we should be prepared that JPM’s problems will be growing dramatically as these perfect hedges are found not to be so perfect. Mind you, we don’t have to worry about the brilliant executives who built these positions they have all been paid and by the time the 80x losses from this debacle are being paid for by the bailout team at the fed and treasury these guys will be on their boat in the islands sipping pina colada’s.

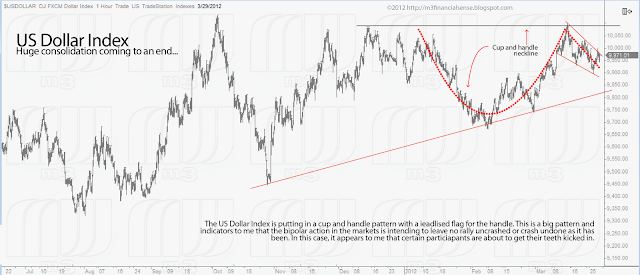

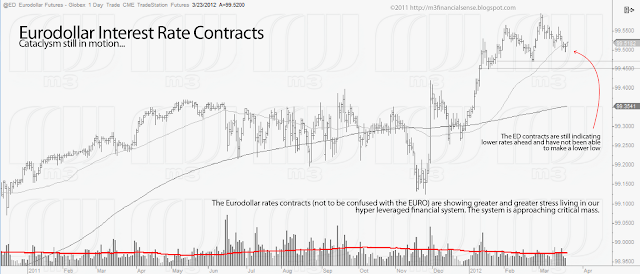

As these huge money amplification schemes become unwound and are socialized all over the globe one can expect a very unfavorable outcome: persistent asset sales, further credit contraction and a gargantuan dollar shortage. So, don’t be surprised to see that the best trade of our era is long dollar and also don't be surprised by the social upheaval that comes along with this process. All these idiotic banks are short dollar via their massive and corrupt money amplification schemes.

Ben BURNanke defers to Jamie Dimon because he works for him and a few other cronyist interested parties. He will do so again and nothing substantial will come of his regulatory examination. In fact, men like Jamie Dimon, Lloyd Blankfein and Ben BURNanke should be criminally investigated for their, misrepresentations, theft and manipulation of US constituent’s assets.

For now, Ben BURNanke now has to go from worrying about stock prices to figuring out how to get "control-P" rerouted to the main branch of the Fed: JPM...