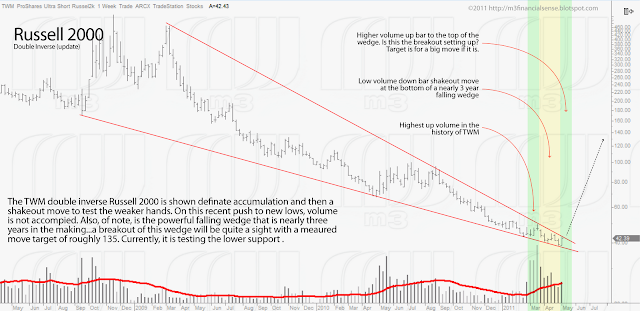

The Price to Earnings ratio for the Russell is in the stratosphere...real bubble territory. Our wedge is nearly complete and volume has come back into this inverse ETF as the index gets price movement on the downside. While it is common for overthows of these diagonals...it is not mandatory and even though this is such a huge pattern and it seem reasonable that there could be an over through...this weeks volume off the lows suggests that it quite a bit less likely that we get one. These are weekly bars in this chart and already this week we are eclipsing recent weekly trading volumes and very well make a new volume breakout if we get a price breakout to go with it.

The Roots of Nazi Ideology: Arthur Graf J. Gobineau and His Racial-Racist

Political Theory

-

How resentment of the republican ideal of equality stoked the racist

theories of Arthur Graf J. Gobineau.

1 hour ago